Results of the flash survey “NON-TAXABLE BENEFITS: Impact on Czech Companies in China”

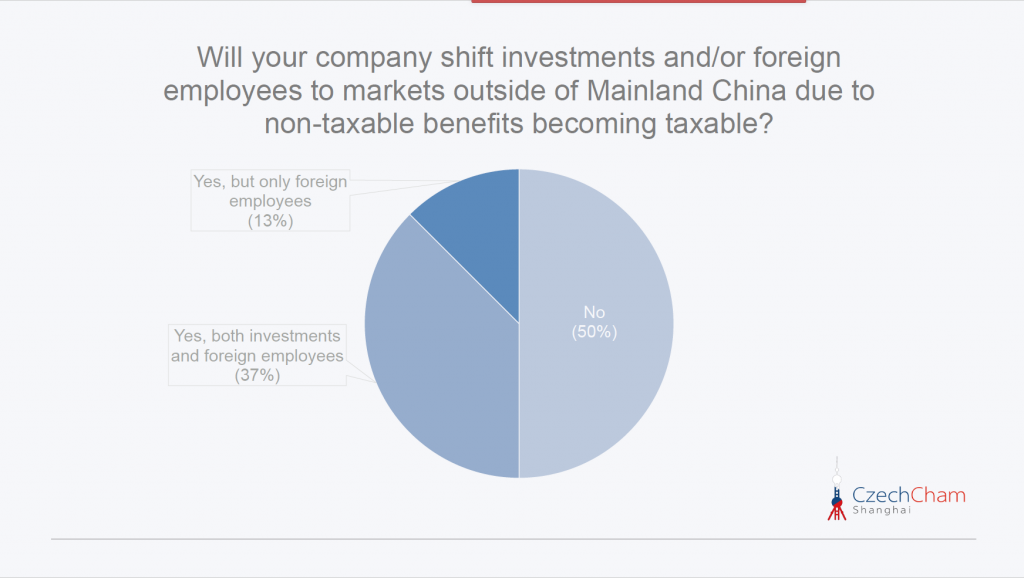

37% of respondent companies are planning to shift both investments and foreign employees to markets outside of Mainland China. Another 13% of companies plan to only shift their foreign employees outside of Mainland China, but not their investments. Moreover, a quarter of respondent companies is likely to reduce foreign assignments by more than 50%.

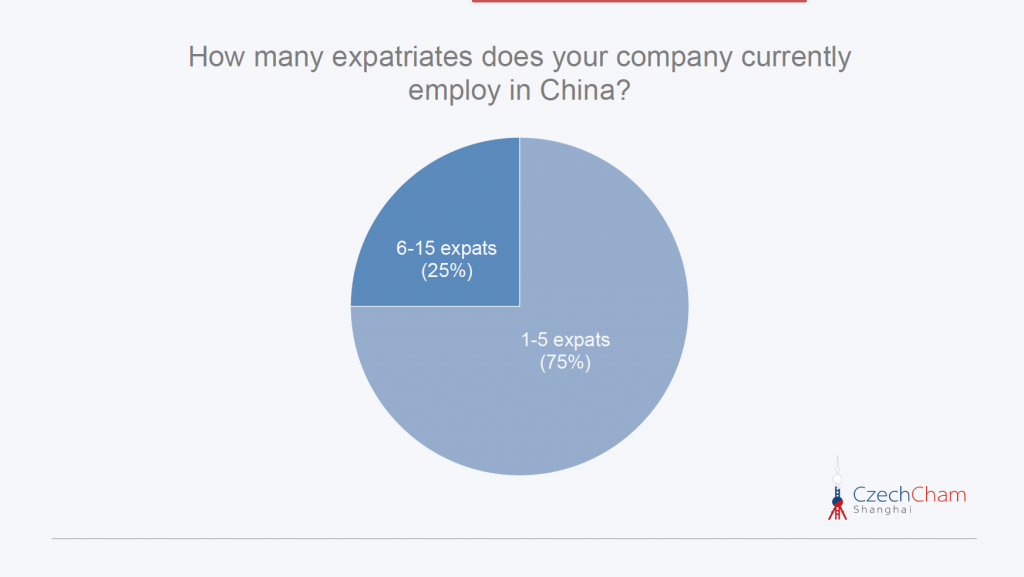

The survey was organized by CzechCham between 15th and 20th April 2021 a total of 8 Czech companies with their business in China participated in an anonymous flash survey regarding the new policy on some non-taxable fringe benefits for expats in China.

1 January 2022 will be the date when three major allowances for expatriates (housing rental, child education, and language training) will cease to be an individual income tax (IIT) exempt – instead, they will be replaced by six other deductions which are unfortunately capped at a very low level This will result in a drastic cut to take home pays On the same date, the IIT benefit for annual bonus is also clicking for an ending for all tax residents including expatriate staff in China.

Executive Summary

- 37% of respondent companies are planning to shift both investments and foreign employees to markets outside of Mainland China.

- Another 13% of companies plan to only shift their foreign employees outside of Mainland China, but not their investments

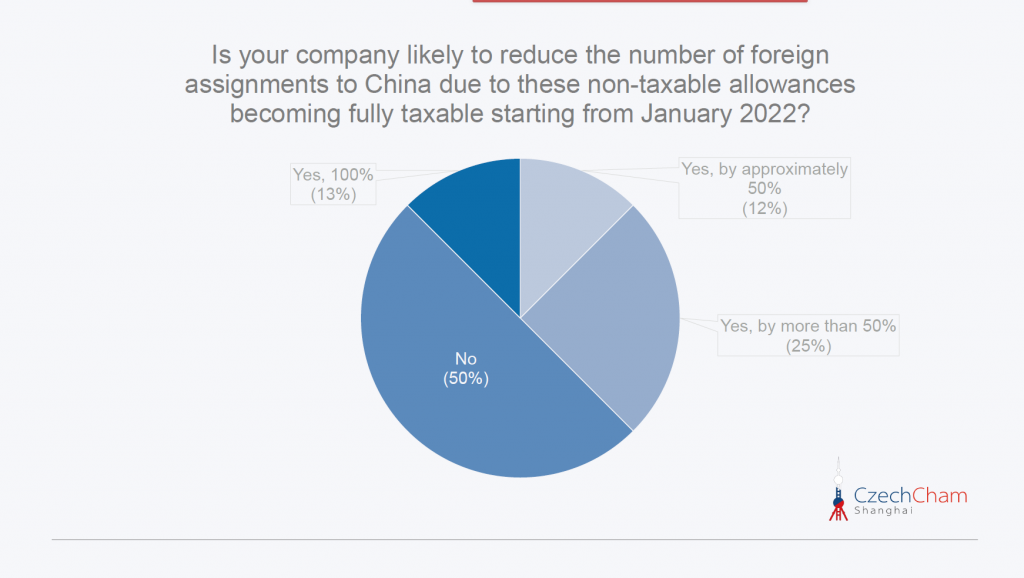

- Moreover, a quarter of respondent companies is likely to reduce foreign assignments by more than 50%.

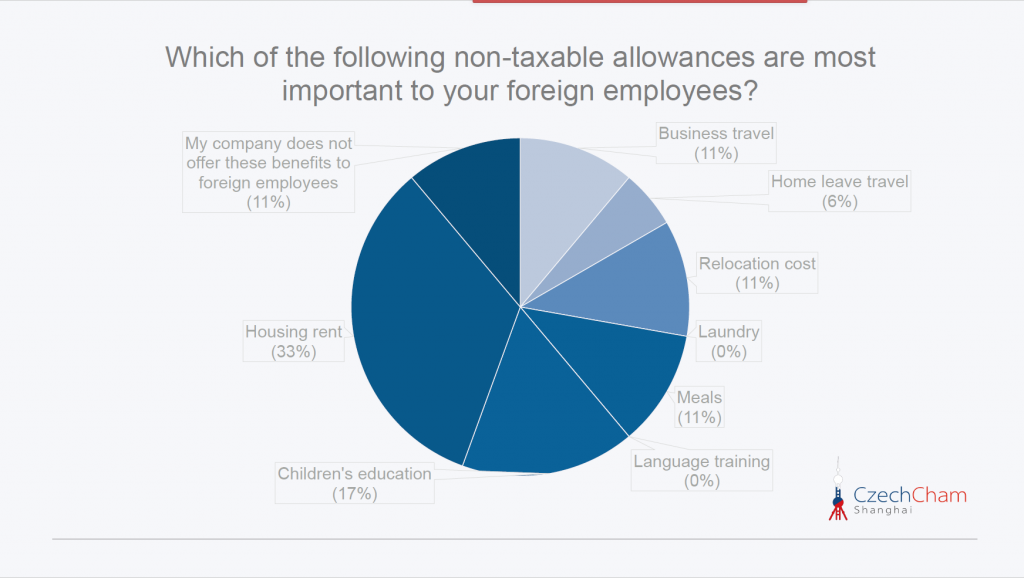

- The results of the survey show that housing rent and children’s education are among the most important non-taxable allowances to Czech companies’ foreign employees, while 11% of Czech companies do not offer such benefits to their foreign employees in China.

Main Findings

© 2021 by CzechCham in Shanghai, all rights reserved. This study may not be reproduced either in part or in full without the prior written consent of the CzechCham in Shanghai.