After our first successful webinar, CzechCham hosted yet another insightful webinar on April 2nd, this time looking into finance and investment opportunities with guest speakers Armando Flores Chiu (Coach in personal finances, Financially Fit with Chiu) and Ricardo Sierra (General Manager, RSL Consulting), who introduced the basics of financial investment planning and talked about the consequences of COVID-19 outbreak on investments. 50 people registered for the webinar.

At the beginning of the webinar, the participants were asked a question whether they think crisis is a good time to make an investment. The majority said yes, with Ricardo and Chiu thinking so too.

When talking about what exactly investing means, there might be some misconceptions. The one thing to keep in mind is that investing has a strategy, unlike gambling, and you have to understand how much risk you put in it. As one saying goes “An investor without investment objectives is like a traveler without a destination.” Ricardo has pointed out, that even with a sound strategy, it doesn’t mean it’s risk-free. After all, failing is part of the process. Investment can be an exchange of resources, and in return getting something of a higher value. Don’t purely think of it in terms of money, but as well as the time you invest.

“An investor without investment objectives is like a traveler without a destination.”

Anonymous

What is a passive and active investment? When talking about passive investments, these are not actively managed, basically working for themselves, such as participation in Nasdaq 100, Airbnb, certificate deposits, mutual funds or P2P loans, among others. You can imagine passive investment as a pint of beer, with a beer foam on the top. The foam produces money, without actually touching your assets. Ricardo has admitted that two out of four of his passive investments are not generating an income at the moment, however this is a normal phenomenon. Active investments then can be Forex, your day job or managing rental properties, for example. As Chiu stressed out, important is to not put all your eggs in one basket.

So where to start and how to reach financial freedom? First of all, you have to have goals, smart goals to be precise. Those goals must be attainable and relevant to your life. Another thing is to try to keep your investments as simple as possible, Chiu suggests, unless you are experienced or have somebody who does it for you.

“Risk comes from not knowing what you are doing.”

Warren Buffet

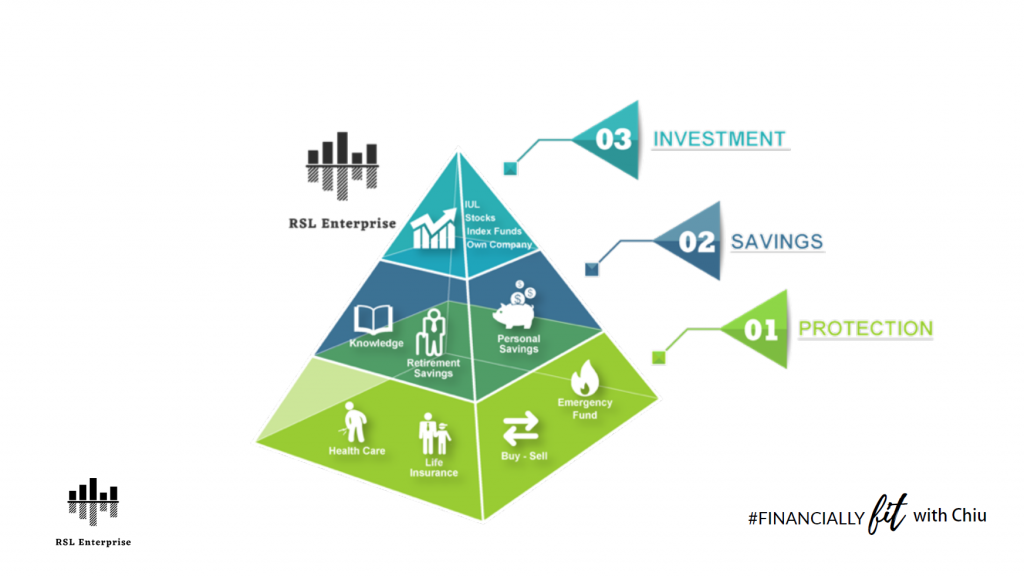

To better understand the process of investing, the investment pyramid is a great way to illustrate why is it important to have a ‘protection layer’ before starting investing. This protection layer consists of four pillars necessary for successful investments – health insurance, life insurance, buy & sell (money used on daily bases), as well as having emergency funds at your disposal. Regarding the emergency funds, Ricardo suggests to have the amount of 4 to 6 month of your average monthly expenses available, all liquid and accessible within 48 hours in case of need.

Remember that you cannot simply invest without going through all the layers as shown in the pyramid below. Once your protection layer is all set, you can move onto savings – such as personal savings or retirement funds. For those who consider themselves ‘global citizens’, Chiu would opt for an international retirement plan, regardless of where in the world you might be.

“Invest in yourself. Your career is the engine of your wealth.”

Paul Clitheroe

On the advice for coronavirus investments, you would want to go with investments that will go back to normal in the long run. The most important is, to first make your emergency plan, then retirement plan and after you make sure you are all set in this regard, start working on your investment strategy.

If you would like to follow up with individual questions, you can get in touch with Ricardo and Chiu by scanning the QR code below.